Have you ever asked yourself why the average conversion rate in e-commerce is only 3 per cent? I admit that this can have many different reasons. However, from the consumer’s point of view, four different categories can be defined. I’ll explain what these are in this blog article.

In the following article, I would like to introduce you to the four biggest risks associated with online purchases from the customer’s perspective and give you tips on what you can do about them. You will learn which risks a shop visitor is confronted with and which measures you can proactively implement to minimise these risks and thus increase the likelihood of a purchase.

From the customer’s perspective, the four risks are divided into

- Functional risk

- Personal risk

- Time risk

- Financial risk

As an online shop operator, you have a hard time

The competition in e-commerce is huge. There are 120,000 online shops in Germany alone. From smaller competitors with good products to huge platforms such as real.de or Amazon. They are all vying for the attention and – at the end of the day – the customers’ money. According to a study by Schwarze Consulting, if you generate 6 million euros in sales per year with your shop, you will end up in the top 1000 list. Ouch, you would have thought that with a turnover of 6 million euros you would already be one of the big fish. Far from it! What’s more, we Germans are returns champions. According to the EHI study, every fifth parcel is sent back.

WooCommerce Hosting

With WooCommerce hosting, you can launch your own online store quickly and securely and manage it professionally – without any technical hurdles. Check our Raidboxes WooCommerce Hosting now.

Imagine your online shop had 1,000,000 visitors last month. Hats off for that! And now let’s take the average conversion rate of 3 per cent. That means you generated 30,000 sales. With an average order value of 50 euros per order, that’s 1,500,000 euros in sales per month. That’s great! But now just imagine that your conversion rate was one percentage point higher, i.e. 4 per cent. Then your turnover would no longer be €1,500,000, but €2,000,000. And that’s with such a small increase in the conversion rate – let’s leave out the returns for now.

However, users on the move on their smartphone or desktop have even bigger problems. When searching for a product, it is highly likely that they will not only come across you and your shop – but also one, two or three of the almost 119,999 other shops. But why does the user buy from the competition and not from you? This is where the four biggest risks that users have to deal with come into play.

4 risks that your customers face when buying online

1. functional risk

The functional risk describes the fact that the user cannot check the quality or functionality of the product themselves when purchasing online. This sounds totally trivial, but it is still an enormous hurdle for visitors to your online shop. Regardless of whether you sell your own products or are a reseller.

At the end of the day, many internet users know how much money and effort is invested in high-quality campaigns, product photos and marketing per se. Just google “online shopping fail” or “aliexpress fail” and you will see how far apart what is promised and what is actually delivered can be.

The good news is that you can counteract functional risk with a variety of measures and methods.

The online shop snocks.com, for example, offers its customers a 6-month guarantee on all products in its own store, as well as free returns, thereby proactively preventing functional risk. The company even goes one better and offers an “anti-hole guarantee” on its products – and formulates this very freely and loosely on the website:

However, large companies and premium brands also counteract this risk by extending the statutory right of cancellation for distance selling contracts from 14 days to an accommodating 30-day return policy. Such measures are popular because they make the customer feel more secure about their product purchase. Well-known examples include the premium brand Zwilling from the cookware and utensils sector or, of course, the giant Amazon, which has already extended its returns policy until 31 January for orders placed in November due to Christmas sales.

2. personal risk

Personal risk mainly relates to the misuse of personal data, such as the unauthorised disclosure of email addresses. Although personal risk played a greater role before the European General Data Protection Regulation (GDPR) came into force than it does today, it is still not to be scoffed at in the age of cookies and advertising emails.

With the help of the GDPR and the new ECJ judgement on cookie consent, the legislator has already (attempted to) put a stop to data misuse, which has been partially successful. Nevertheless, before buying from an unknown provider, users should consider how trustworthy the provider really is and whether their personal data is really in good hands with them.

Here too, trust and security symbols, such as SSL encryption or the correct explanation of the use of cookies when entering the site, can be the right step to gain the trust of shop visitors.

Because one thing is very clear: nothing destroys a customer relationship as quickly as unauthorised advertising emails, spam or when the customer feels betrayed by you. So be honest and as transparent as possible with your customers!

3. temporal risk

Online shop visitors perceive the risk of their ordered goods not arriving on time, or only with considerably long delivery times, as a time risk. This risk is also supposedly trivial. Especially in uncertain situations such as the current coronavirus crisis, many online shoppers ask themselves: When will I actually receive my goods? Will I receive my order much later now?

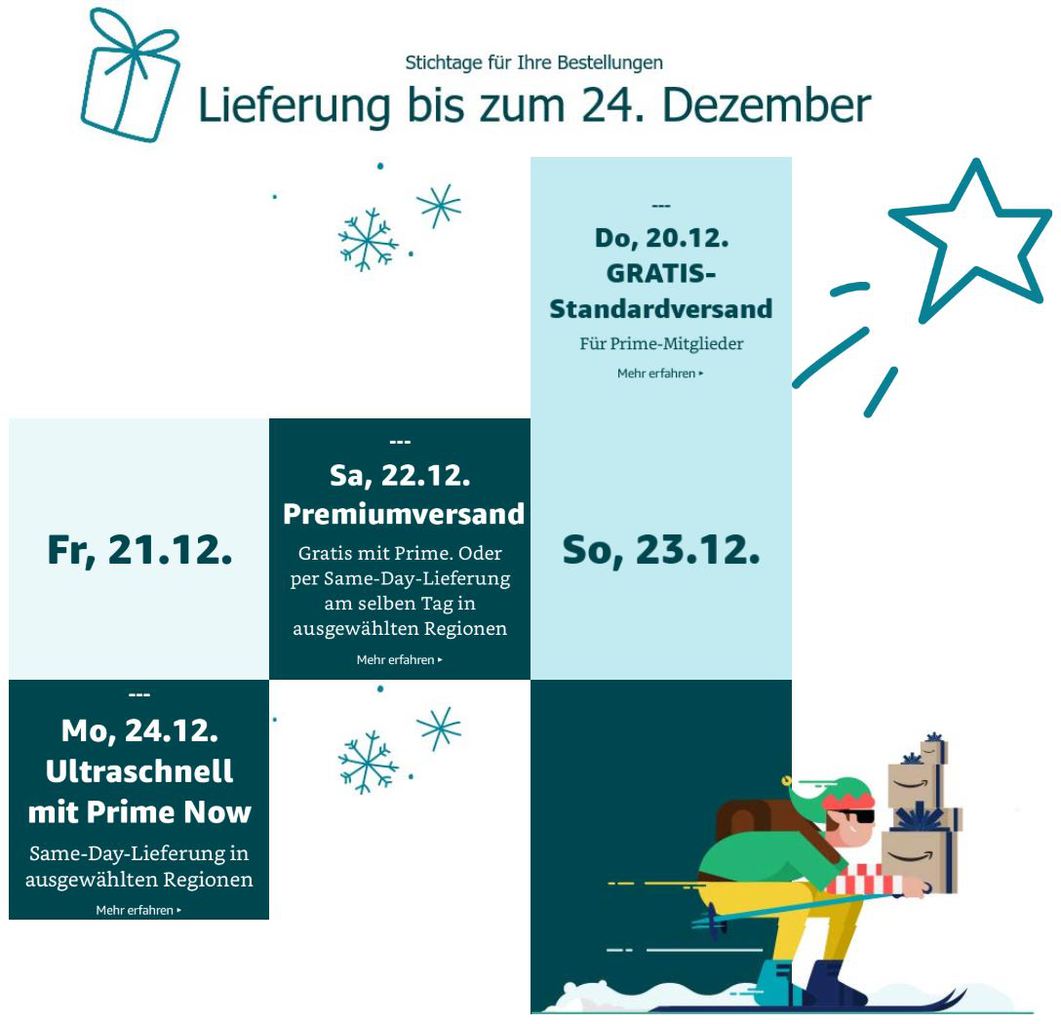

Similar trains of thought occur in a less exceptional situation like now: at Christmas. Every year, thousands and thousands of people ask themselves the same question: Will my order (or the gift I ordered) arrive before Christmas?

Amazon has always been the frontrunner in solving this problem. Even on 24 December, Amazon guaranteed same-day delivery in selected regions, thereby reducing the time risk for its customers to virtually zero.

Now you’re not Amazon, I know. But simple information on the product pages or on your homepage about delivery times is enough for many customers to minimise the perceived uncertainty.

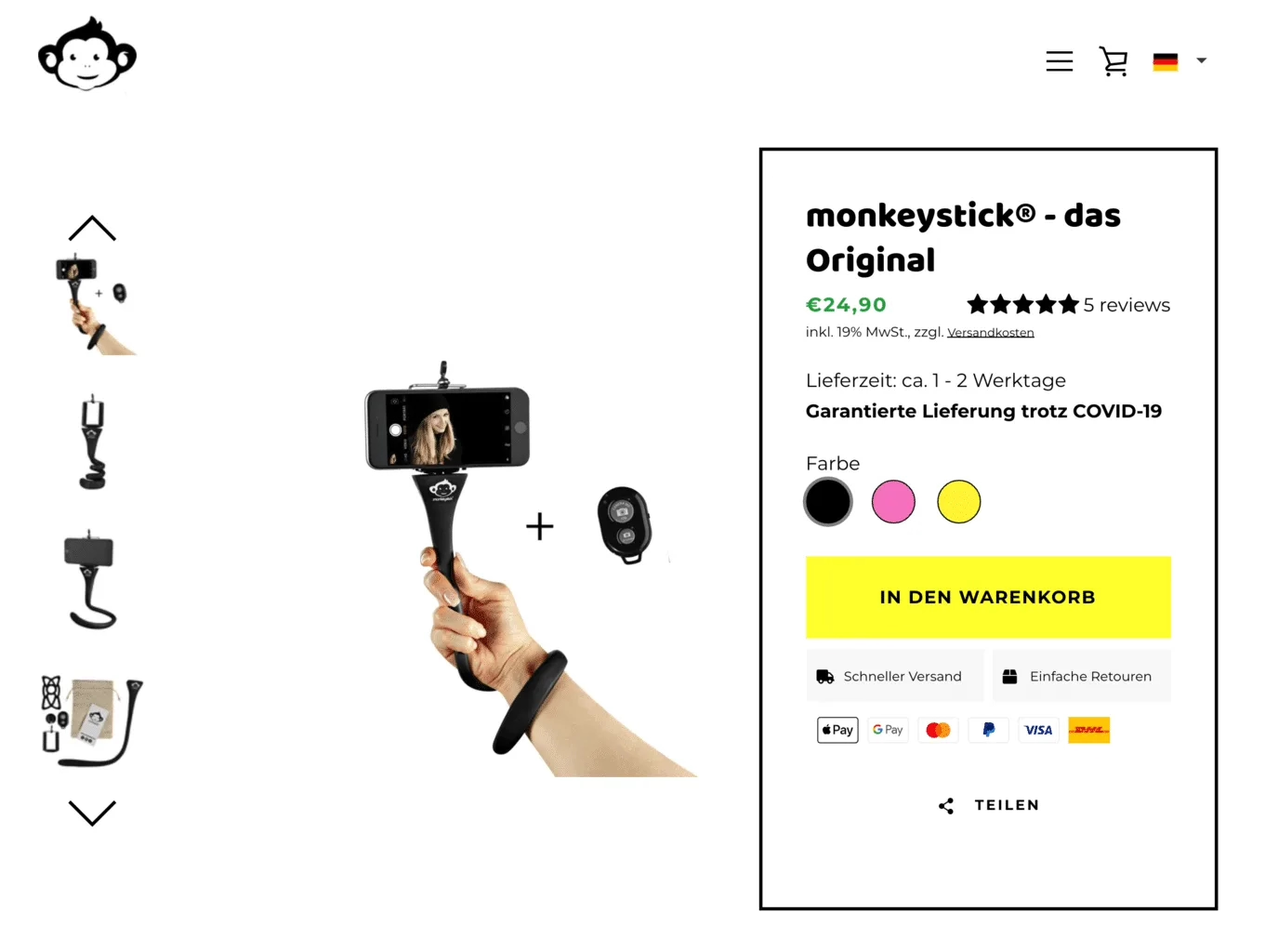

Many online shops (e.g. sternglas.de or monkeystick.de) have integrated information on their product detail pages or the homepage, as customer enquiries about delivery times have increased due to COVID-19.

In any case (pandemic or not), talk to your shipping service providers and calculate an approximate delivery time. Communicate this! And ideally, you should send your customers a tracking ID after they place their order so that they can follow the delivery of the product virtually live.

The time risk in the event of a complaint or exchange is also important. You should respond to your customers quickly and not put them on the back burner. In the end, the customer will honour you with more trust.

4. financial risk

For potential buyers – and in the theory of e-commerce – the financial risk is the risk with the greatest influence on the purchase decision. The financial risk includes all the customer’s thoughts and worries about what will happen to the money paid in the event of a return or complaint.

Am I stuck with the costs? Will I get my money back? Is the shop even secure? Should I really leave my credit card details here?

Think back to your online purchases from sellers that you may not have known very well. But you really wanted the item on offer there and the price was simply the best at the online shop in question. Incidentally, this happens to me regularly when I use a price comparator like Idealo to find the cheapest supplier. Which of the following payment methods would you use?

- Credit card

- Prepayment

- Invoice

- Paypal

According to the E-Commerce in Europe study by PostNord (the Scandinavian DHL, so to speak), payment methods such as PayPal or similar are extremely far ahead in Germany with a share of 50 per cent. This is followed by purchase on account with 24 per cent and only then comes direct debit or credit card with 18 per cent. Sure, that’s typically German! So this is not really breaking news.

Content marketing for advanced users: The 6 most important levers

Discover how to optimize your content marketing to reach the right audience, build trust, and achieve long-term success.

But our European neighbours are on a similar path – albeit not as drastically. Take a look at the study on page 25: In Italy, over 55 per cent pay with PayPal or similar services, in the Scandinavian region the figure is 21 per cent (purchase on account at 12 per cent) and the figures are similarly distributed among our Dutch colleagues: Credit card: 30 per cent, PayPal or similar: 29 per cent, purchase on account 21 per cent. PayPal’s two biggest assets are buyer protection and fraud protection.

To go back to the example I just gave: I would have paid with PayPal. And you?

The more (established) payment providers I make available to my customer, the more likely it is that there is exactly the right one for them – the one they feel most secure with. Seals relating to encryption (SSL) also generally work very well to reduce the perceived financial risk.

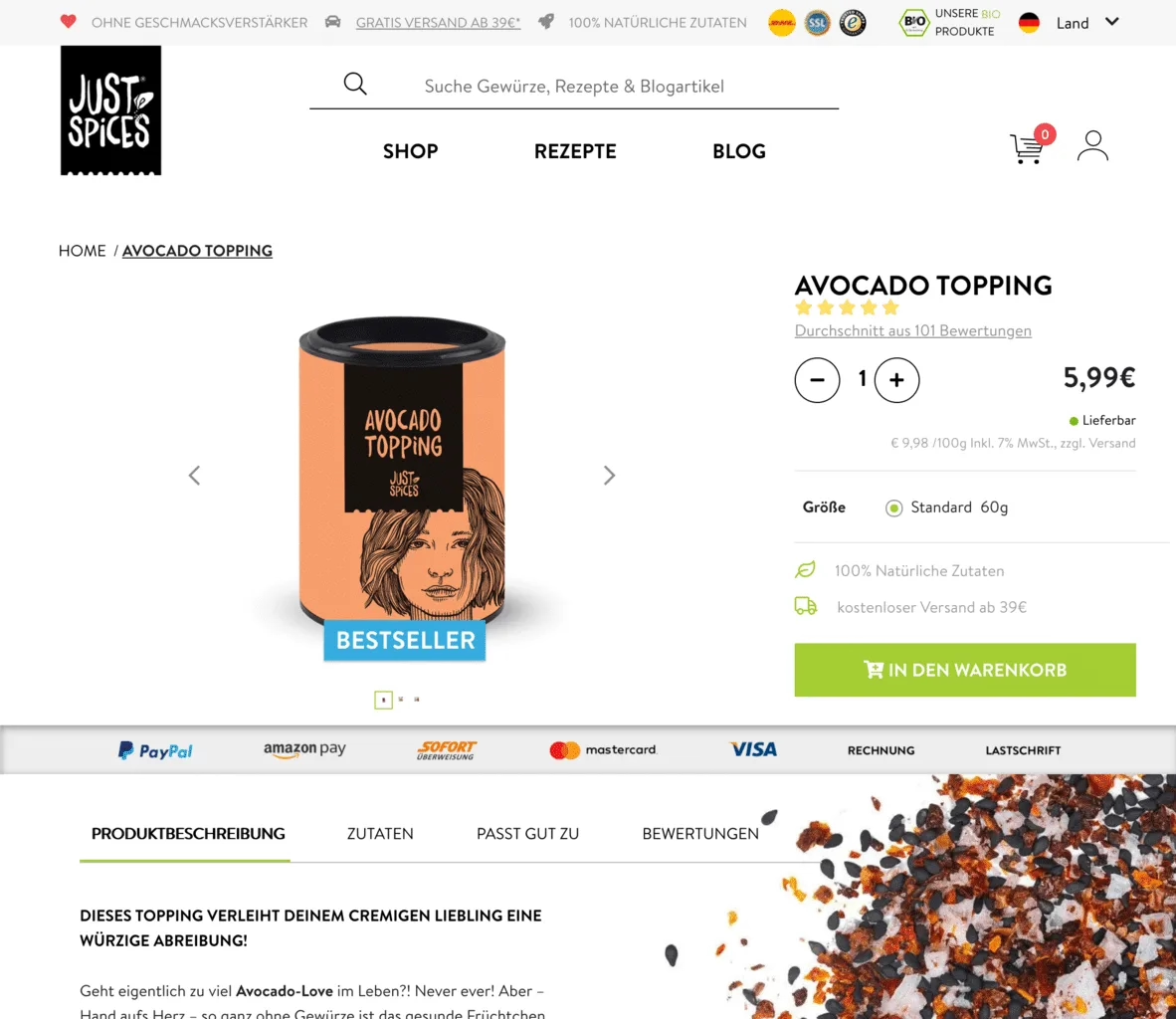

The Düsseldorf start-up Just Spices, for example, integrates all payment methods as well as shop ratings and encryption using SSL. This allows trust to be established between the user and the online shop at a later stage or at a later point in the customer journey.

Conclusion

All four of these risks are not unique. Customers are often confronted with all four at the same time, especially when dealing with a new shop – albeit not with the same intensity.

The risks from the customer’s perspective are much greater, especially with smaller and less well-known online shops. That’s why you don’t see SSL seals at MediaMarkt or Amazon, for example, because these players have earned the trust of customers over the years and are no longer equally exposed to all risks.

My tip

Don’t immediately start tackling all four risks in equal measure and overwhelm your store with seals, symbols and information – your product should still be the focus. But you can think about how you can specifically deal with these four risks and what you can do step-by-step to minimize them.

For example, if you have a shop for an older target group, the financial and personal risk may dominate. With a younger target group, who are also more familiar with online rights (keyword: 14-day right of return), the time risk may dominate.

It is important that you “pick up” the customer in the right place and build trust with them as quickly as possible. You can learn more about your target group with the help of A/B tests: Which of these risks influences your (potential) customers the most? Which risk should you tackle first?

If you learn these things about your customers and respond to them accordingly, your conversion rate will also improve sustainably. That’s a promise.

Leave a Reply